How to save at Cabela’s?

1. You should sign up for their free mobile alert program and enjoy $10 off your next $50+ order

2. Keep an eye on the home page and various coupons and offers displayed there

3. Always start shopping at “Bargain Cave” where you will find discounts of up to 70% on various overstock and clearance items.

4. Sign up for free promotional emails and you will always know about special deals and sales events.

5. There are always mail-in rebates, free shipping, and free gift promotions going on. You can save up to $500 with mail-in rebates alone!

6. If you can find the same item that is cheaper at Cabela’s competitor store within 100 miles, you will get that lower price without any hassle.

7. Cabela’s offers lifetime warranty on their private brand and 1 year warranty on all other store-bought products.

8. You have 90 days to return or exchange everything.

9. Cabela’s offers coupons directly in your shopping cart that match items you are selecting while shopping, so you never miss a deal.

10. You get free 2-day shipping and $50 off boots and tents, 30% off kayaks of $250+, 15% off coolers, and $100 off gun safes.

11. You can join Cabela’s Club and get 2% back in CLUB points for all purchases. When you become a member of this club, you will get points that never expire, earn free gear, and won’t have any annual fees with Visa card.

What are all the benefits of Cabela’s Club rewards program?

1. You will get $25 coupon code just for joining

2. 2% points back at select Cenex gas stations and stores

3. 1% points back on all other purchases outside Cabela’s

4. Invitations to member shopping events

5. $10 in points for each 5 purchases

What discounts will you get at The Bargain Cave?

1. Always great prices on over 10,000 items

2. 70% off gifts

3. $20 mail-in rebates

4. Special Cabela’s bucks for up to $20

What does Cabela’s weekly ad offer?

1. Savings of up to 20% on pistols, GPS, boots, hoodies, ammo, and rifles

2. Offers change weekly, so you will definitely be able to find what you are looking for

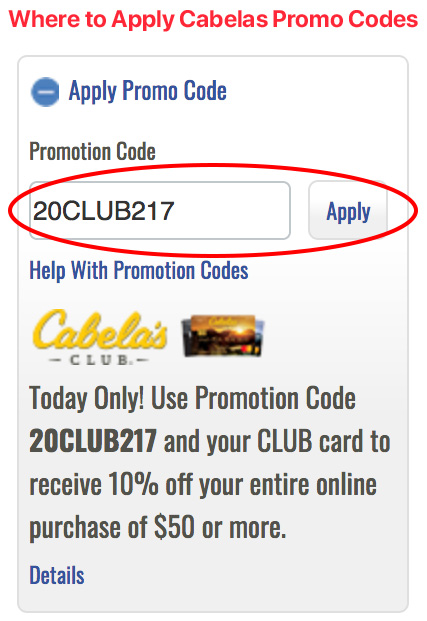

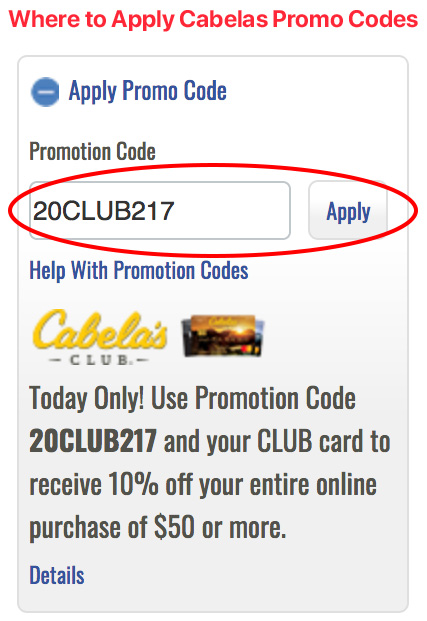

3. Weekly ad offers can be stacked with promo codes

Cabela’s is one of the biggest outdoor stores in the world for everything any hunter, fisherman, or camper can possibly need. The store is always hosting various events and offers plenty of savings on firearms, hunting, fishing, and boating gear.

Even if you are not an avid fly fisherman or hunter, but just like hiking and camping, you will find all you need from top brands, such as Easton, Garmin, Columbia, and Realtree.

What are some of those savings ways and strategies?

Rewards

Since Cabela’s and Bass Pro Shops are together now, Cabela’s Club Rewards and Bass Pro Shops Outdoor Rewards cards are now just Outdoor Rewards card, so that you can receive points and cash in rewards form both of these stores. All Cabela’s customers will be getting new cards in the mail. All rewards points will be redeemed in both locations in-store and online.

Rewards certificates will be mailed or emailed for every $10 earned in points. This amount will have to be redeemed by a certain date or it will expire.

Discounts

This might change in the future, but for now Bass Pro Shops’ coupons do not apply at Cabela’s and vice versa.

Military Discount

All active, veteran, retired, reserve military members and their family, National Guardsmen, and army reserve personnel get 5% at Cabela’s with a valid ID.

In addition to savings, Cabela’s shows its appreciation for military members by inviting them to work for Cabela’s Ability to attend events and individual tournaments. The company also supplies Care Packages for Special Forces Units.

Bass Pro Shops VIP Owner’s Discount

Bass Pro Shops VIP Owner’s Discount works at Cabela’s. In addition to this discount, there are plenty of others that are honored at both stores: Tracker, Nitro, Mako, Sun Tracker, Regency, and Tahoe Boat VIP discounts. Those discounts are honored at both stores, retail points, and some other retail locations and Bass Pro Shops Signature Oregon restaurants:

- Uncle Buck’s Fishbowl and Grill

- Uncle Buck’s Brewery and Steakhouse

- Uncle Buck’s Grill

- Hemingway’s Blue Water Café

- Islamorada Fish Company

- White River Fish House

- Blue Fin Lounge

If you buy one of above mentioned new boats between now and December 31st of 2019, you too can become a VIP discount owner for two years. The discount card will not work online.

Events and promotions

Most promotions will work at both locations. Bass Pro Shops have been hosting Santa’s Wonderland for years and that is just getting better with the same event now available at Cabela’s too. Easter and other special free family events will also continue at both stores.

- Accessories

- Appliances & Electronics

- Arts & Crafts

- Automotive

- Babies & Kids

- Beauty

- Books & Magazines

- Clothing

- Computers

- Dating

- Department Stores

- Entertainment

- Financial and Services

- Flowers & Gifts

- Food & Drink

- Furniture

- Health & Vitamins

- Home & Garden

- Jewelry & Watches

- Kids Activities

- Luggage

- Music

- Office Supplies

- Party Supplies

- Pet Supplies

- Phone & Wireless

- Photo & Photo Gifts

- Shoes

- Sports & Outdoor

- Subscription Boxes

- Toys & Games

- Travel

- Web Hosting & Services

- Weddings

Take Up To 65% Off Apparel, Footwear, Sporting Goods And More at Cabelas

Receive $10 off your first purchase of $75 when you sign up at Cabelas

Receive up to 50% OFF Camping items at Cabela's

Take Up To 50% Off Optics Sale at Cabelas

How to save at Cabela’s?

1. You should sign up for their free mobile alert program and enjoy $10 off your next $50+ order

2. Keep an eye on the home page and various coupons and offers displayed there

3. Always start shopping at “Bargain Cave” where you will find discounts of up to 70% on various overstock and clearance items.

4. Sign up for free promotional emails and you will always know about special deals and sales events.

5. There are always mail-in rebates, free shipping, and free gift promotions going on. You can save up to $500 with mail-in rebates alone!

6. If you can find the same item that is cheaper at Cabela’s competitor store within 100 miles, you will get that lower price without any hassle.

7. Cabela’s offers lifetime warranty on their private brand and 1 year warranty on all other store-bought products.

8. You have 90 days to return or exchange everything.

9. Cabela’s offers coupons directly in your shopping cart that match items you are selecting while shopping, so you never miss a deal.

10. You get free 2-day shipping and $50 off boots and tents, 30% off kayaks of $250+, 15% off coolers, and $100 off gun safes.

11. You can join Cabela’s Club and get 2% back in CLUB points for all purchases. When you become a member of this club, you will get points that never expire, earn free gear, and won’t have any annual fees with Visa card.

What are all the benefits of Cabela’s Club rewards program?

1. You will get $25 coupon code just for joining

2. 2% points back at select Cenex gas stations and stores

3. 1% points back on all other purchases outside Cabela’s

4. Invitations to member shopping events

5. $10 in points for each 5 purchases

What discounts will you get at The Bargain Cave?

1. Always great prices on over 10,000 items

2. 70% off gifts

3. $20 mail-in rebates

4. Special Cabela’s bucks for up to $20

What does Cabela’s weekly ad offer?

1. Savings of up to 20% on pistols, GPS, boots, hoodies, ammo, and rifles

2. Offers change weekly, so you will definitely be able to find what you are looking for

3. Weekly ad offers can be stacked with promo codes

Cabela’s is one of the biggest outdoor stores in the world for everything any hunter, fisherman, or camper can possibly need. The store is always hosting various events and offers plenty of savings on firearms, hunting, fishing, and boating gear.

Even if you are not an avid fly fisherman or hunter, but just like hiking and camping, you will find all you need from top brands, such as Easton, Garmin, Columbia, and Realtree.

What are some of those savings ways and strategies?

Rewards

Since Cabela’s and Bass Pro Shops are together now, Cabela’s Club Rewards and Bass Pro Shops Outdoor Rewards cards are now just Outdoor Rewards card, so that you can receive points and cash in rewards form both of these stores. All Cabela’s customers will be getting new cards in the mail. All rewards points will be redeemed in both locations in-store and online.

Rewards certificates will be mailed or emailed for every $10 earned in points. This amount will have to be redeemed by a certain date or it will expire.

Discounts

This might change in the future, but for now Bass Pro Shops’ coupons do not apply at Cabela’s and vice versa.

Military Discount

All active, veteran, retired, reserve military members and their family, National Guardsmen, and army reserve personnel get 5% at Cabela’s with a valid ID.

In addition to savings, Cabela’s shows its appreciation for military members by inviting them to work for Cabela’s Ability to attend events and individual tournaments. The company also supplies Care Packages for Special Forces Units.

Bass Pro Shops VIP Owner’s Discount

Bass Pro Shops VIP Owner’s Discount works at Cabela’s. In addition to this discount, there are plenty of others that are honored at both stores: Tracker, Nitro, Mako, Sun Tracker, Regency, and Tahoe Boat VIP discounts. Those discounts are honored at both stores, retail points, and some other retail locations and Bass Pro Shops Signature Oregon restaurants:

- Uncle Buck’s Fishbowl and Grill

- Uncle Buck’s Brewery and Steakhouse

- Uncle Buck’s Grill

- Hemingway’s Blue Water Café

- Islamorada Fish Company

- White River Fish House

- Blue Fin Lounge

If you buy one of above mentioned new boats between now and December 31st of 2019, you too can become a VIP discount owner for two years. The discount card will not work online.

Events and promotions

Most promotions will work at both locations. Bass Pro Shops have been hosting Santa’s Wonderland for years and that is just getting better with the same event now available at Cabela’s too. Easter and other special free family events will also continue at both stores.

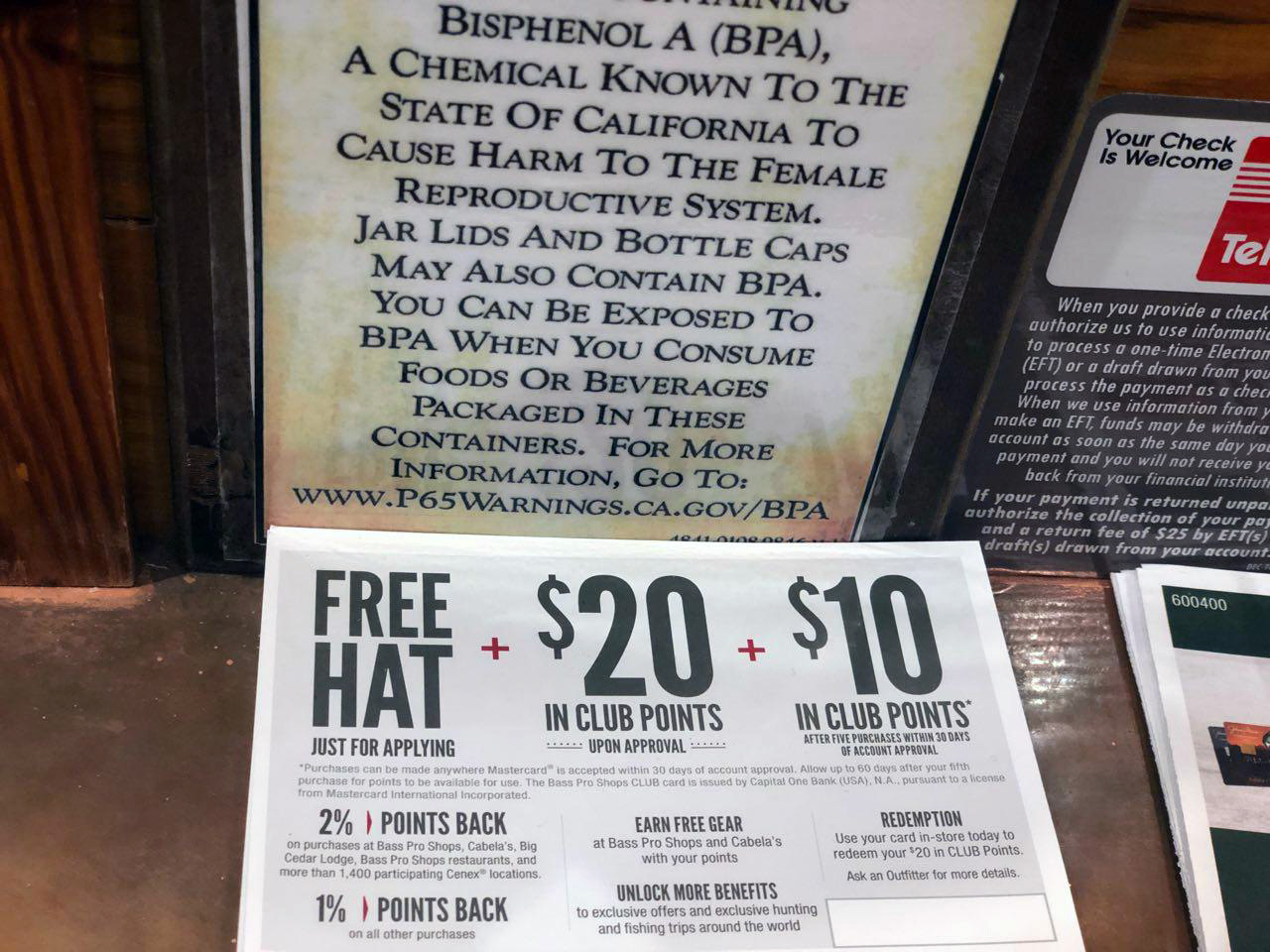

Cabela’s Credit Card is the Best Way to Maximize Your Savings at Cabela’s

If you are an outdoorsy lady or gent, you might be shopping at Cabela’s so much that it feels like home. If it feels like home, you might be leaving a lot of money there. If you are leaving a lot of money there, you might be wondering if having Cabela’s credit card could help you save some of that money. We are here to go over that with you.

Does it make sense to apply for Cabela’s credit card?

First of all and sadly, no – Cabela’s credit card is not the best savings tool. If you get approved after an extensive credit check, you will get $20 off your first purchase. Yes, just $20. If you shop at other places and pay with this card for 5 purchases in the next 30 days, you will get $10 more. There are cards that will give you $500, so there it is.

After the initial cash benefits you will be earning points that are equivalent to 1% cash back per year. This applies to all purchases, except at Cabela’s and Cenex, for which you will get 2%. To get 2% back you don’t even need this credit card, because all free Club Rewards Program members get that automatically.

If you would like to get more perks and benefits, you have to become a big spender. People who spend over $10,000 per year and are approved via very stringent credit check become Cabela’s CLUB Visa Silver Card holders and get 3% cash back. All you have to do is buy a fancy motor boat or yacht every year and you’ll have it made. $25,000 and over per year will make you Cabela’s CLUB Visa Black Card holder and reward you with 5%. We don’t even know what you have to buy to become that.

If you become a respected holder of the latter two cards, the savings are a bit more significant than with the regular card’s 1% and 2%. Many stores routinely offer 5% cash back for store purchases without $25,000 and without annual fee. Cabela’s credit card does not have an annual fee and this might the sole reason why you might consider opening it to save at Cabela’s and Cenex.

What are the pros of Cabela’s Credit Card?

$30 opening bonus

$20 will come to you right after opening the card and will be applied towards your first purchase with it. $10 will come if you’ll make 5 purchases somewhere else in the first month. You will get this $10 within 60 days after the fifth purchase.

2% cash back

You will get 1 point for $1 spent in all stores and 2 points for $1 spent at Cabela’s and Cenex. This is not cash rewards, but definitely money for future Cabela’s purchases.

No annual fee

Credit cards usually carry an average of $19 annual fee, so by not having it here you are saving that much.

Low APR

The APR is not very high for Cabela’s purchases, but still you should definitely pay the balance off at the end of every billing cycle and not have any ongoing debt on this or any other credit card.

What are the Cons of Cabela’s Credit Card?

1. Financing

2. Cabela’s Credit card doesn’t offer any introductory rates and hits you with 26.49% right away. Most other credit cards offer 0% rate for the first year. This rate is for non-Cabela’s purchases. You will be charged 27.49% for cash advances and 4% for balance-transfers. The average APR for good credit is around 20%, but modern credit cards rarely give such low percentage, so this is not surprising. Cabela’s purchases are only 9.99% APR, which is not bad. But again, no percentage is good if you can avoid it all together by paying your credit card balances off right away.

3. 1% Foreign transaction fee

If you decide to enjoy the great outdoors or anything else outside of the US, you will pay for it with 1% surcharge on all foreign transactions. You will pay this fee even if you are here and just buying something from abroad. This 1% fee is not the highest in the credit card market, but still a fee when compared with no foreign transaction cards.

Is there something else we should know about this card?

- The points don’t expire unless you don’t pay, so don’t be in the rush to use them.

- There is no penalty APR or Overlimit Fee, but you should still avoid ever getting to such situations. Don’t be late with payments and don’t spend more than you have allowance for if you want to be smart about your finances, which you always should.

- 4% balance transfer fee is another nail in the coffin for this card, which is already punishing you with its 26.49% APR.

- Special Offers and Events – all card holders and rewards program members are eligible for special events. Silver and Black card owners get invited to Signature Travel Adventures and “The Experience”. All of those are planned hunting and fishing trips. “The Experience” is an access to see how hunting, fishing, and outdoor companies go about their business on a daily basis. You can visit the likes of Zeiss, Ruger, and Simms.

Recommended for You

-

Best Times to Fish Is Now! Coolest Fishing Gear from Sierra and Cabela'sFishing lures are tools that work as contraptions and also look fun. They can be pretty pricey, so some research and comparison is needed. In this article we will go over some of the best brands and best prices to help you fill up your boxes and tackles....more...

-

Bass Pro Shops and Cabela's Free Hunting ClassesOutdoor oriented retailers are getting ready and excited for fall season and hunting. Bass Pro Shops and Cabela's are the biggest such stores and both are hosting various events, seminars, and practice classes in preparation for hunting activities....more...

-

The Appeal of Cabela's is RealMeet Cabela's - Disneyland for Adults. How It All Started....more...

-

Why You Should Visit Cabela'sVisiting a physical store of Cabela's is an exciting experience kindling lighthearted pleasure. People of all ages will walk out feeling enjoyed. Let me tell you about my experience while visiting Cabela's in Reno, Nevada....more...

- Accessories

- Appliances & Electronics

- Arts & Crafts

- Automotive

- Babies & Kids

- Beauty

- Books & Magazines

- Clothing

- Computers

- Dating

- Department Stores

- Entertainment

- Financial and Services

- Flowers & Gifts

- Food & Drink

- Furniture

- Health & Vitamins

- Home & Garden

- Jewelry & Watches

- Kids Activities

- Luggage

- Music

- Office Supplies

- Party Supplies

- Pet Supplies

- Phone & Wireless

- Photo & Photo Gifts

- Shoes

- Sports & Outdoor

- Subscription Boxes

- Toys & Games

- Travel

- Web Hosting & Services

- Weddings